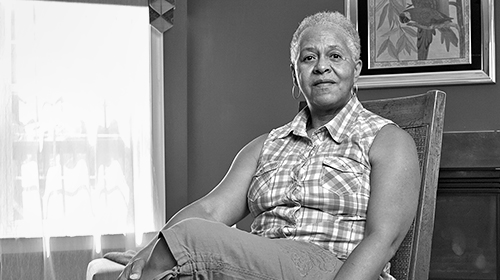

For years, Rita Winters envisioned spending her golden years of retirement at her dream house in Southern Maryland. However, as a result of events outside of Rita’s control, her dream home placed her in a nightmare situation. Federal action is needed to stop the nightmare that Rita and millions others faced while attempting to achieve their dream of home ownership.

Rita Winters’ Story

After building equity in her home for six years, Rita decided to refinance and take out a second mortgage to cover some of her family’s additional expenses. Unfortunately for Rita, she was caught in the same predatory lending trap that so many other people of color found themselves in over the past few years.

In predominantly Black and Latino communities, unscrupulous mortgage brokers, looking to make a profit in historically untapped and neglected markets, targeted people like Rita for risky re-finance mortgages, often with high costs and fees, and interest-only payments that ballooned after two or three years. In a rushed deal that closed in less than an hour, Rita re-financed her home, ending up with a high-cost interest-only loan that included $20,000 in origination fees and nearly doubled her monthly payment, exceeding more than half her income.

Although Rita and her family managed to cover their new exorbitantly high mortgage payments until mid-2010, their financial situation – like that of so many families during the global recession – deteriorated, resulting in the initiation of foreclosure proceedings. To make matters worse, Rita’s loan, as many were at the time, was sold off by her lender as a mortgage-backed security. Since the mortgage note was now owned by a multitude of investors, it became nearly impossible for Rita to re-finance and stay in her home because of the challenges in securing approval from investors with different financial interests in the loan, all of whom would have to agree to re-finance.

Lasting Impact of Rampant Predatory Lending Exposed in ACLU Report Justice Foreclosed

Rita’s story is only one example of the rampant predatory lending targeted to communities of color across the country during the peak of the housing market. In Justice Foreclosed, an ACLU report released last month, we examine the lasting impact that these predatory lending practices, fueled by Wall Street’s demand for high-risk loans, have had on communities of color. Further, we recommend federal action to prevent these discriminatory practices from repeating.

The report highlights that in the five years since the housing bubble burst, 3.5 million households lost their homes to foreclosure, with Black and Latino homeowners disproportionately impacted. This lopsided effect on communities of color around the country was driven by predatory lending, and rooted in our nation’s ongoing residential segregation and housing discrimination. The long-term harm to these communities will take years to address, because minority families hold more of their wealth in housing. The ripple effect of the loss of housing wealth on minority families results in a loss of inter-generational wealth, which can no longer be passed down to other generations.

Federal Action Needed

In Justice Forcelosed, we highlight key steps Congress and the Administration must take to deter financial institutions from the discriminatory and predatory practices that harmed Rita and so many others across the country. This includes increasing the civil penalties when banks and financial institutions violate the Fair Housing Act (FHA) and the Equal Credit Opportunity Act (ECOA) by engaging in discriminatory lending. Under the FHA, a violation that affects hundreds of individuals could be considered a single violation, resulting in a penalty to the financial institution of only $16,000. Putting that into perspective, the loan origination fee that the financial institution charged Rita alone was $20,000. When it only takes one origination fee to cover the cost of a penalty that resulted because hundreds of individuals were discriminated against through predatory lending, any potential deterrent effect on a financial institution to change their practices goes out the window.

Another key step is increasingfunding to the Department of Justice, so that it may adequately investigate and prosecute fair housing violations. When financial institutions know that they will be held accountable for their actions, they will be deterred from instigating discriminatory lending and create greater transparency and accountability within their own institutions. If this accountability and transparency were in place at the height of the housing bubble, Rita could have been spared the pain and loss of wealth that she faces today due to a looming foreclosure.

Action is necessary to stop the nightmare that Rita, and millions of others, faced while attempting to achieve the dream of homeownership. Additional federal policy recommendations may be found in our full report, Justice Foreclosed. The ACLU continues to fight and advocate for fair housing, including, through recently filed litigation in Adkins v. Morgan Stanley and recently submitted comments to the Consumer Financial Protection Bureau.

Learn more about predatory lending: Sign up for breaking news alerts, follow us on Twitter, and like us on Facebook.